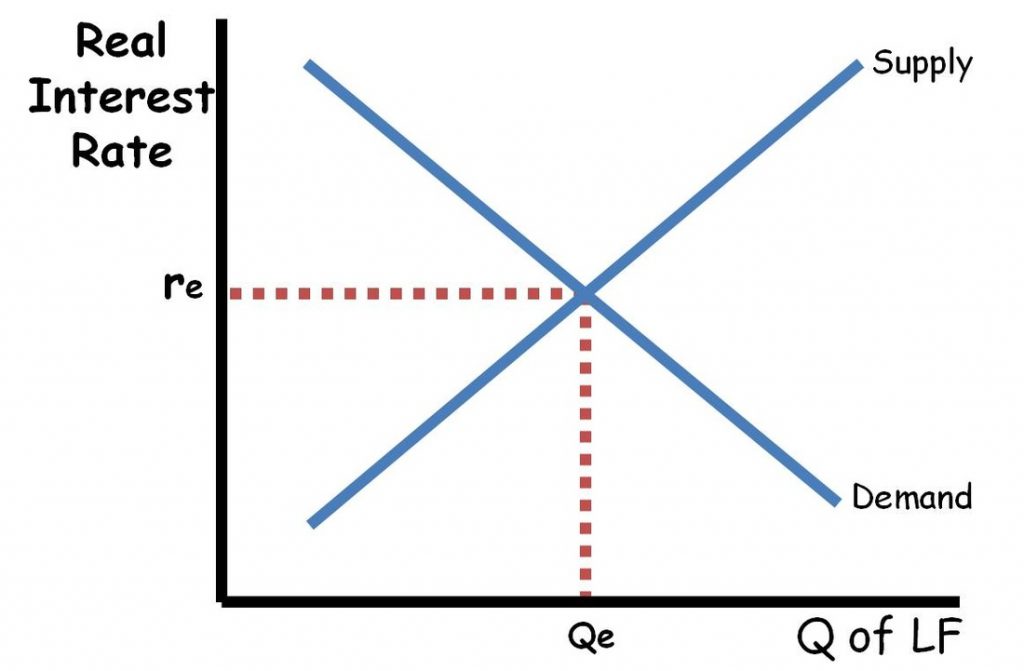

Shifters Of The Loanable Funds Market . S 2 indicates a decrease (shift to the left) of the supply curve. the result will be an outward shift of the supply curve. the loanable funds market with two alternative shifts in the supply of loanable funds. the horizontal axis of the financial market shows the quantity of money that is loaned or borrowed in this market. 12 the market for loanable funds. the loanable funds theory is a fundamental concept in economics that explains how the supply and demand for loanable funds affect interest rates in an economy. In any given period, some. The loanable funds theory was formulated in the 1930s by british economist dennis robertson and swedish economist bertil ohlin. 4.3 definition, measurement, and functions of. The vertical axis measures the real rate of. the loanable funds market is an economic model used to analyze the market equilibrium for interest rates. Lumen learning, macroeconomics, introduction to financial markets. At this point, more money is coming into. This causes an increase in private savings, which increases national savings. S 1 indicates an increase.

from www.reviewecon.com

The vertical axis measures the real rate of. In any given period, some. 4.3 definition, measurement, and functions of. S 1 indicates an increase. At this point, more money is coming into. the horizontal axis of the financial market shows the quantity of money that is loaned or borrowed in this market. This causes an increase in private savings, which increases national savings. S 2 indicates a decrease (shift to the left) of the supply curve. 12 the market for loanable funds. the loanable funds market with two alternative shifts in the supply of loanable funds.

What to know about Loanable Funds by test day

Shifters Of The Loanable Funds Market The loanable funds theory was formulated in the 1930s by british economist dennis robertson and swedish economist bertil ohlin. The vertical axis measures the real rate of. the loanable funds theory is a fundamental concept in economics that explains how the supply and demand for loanable funds affect interest rates in an economy. the horizontal axis of the financial market shows the quantity of money that is loaned or borrowed in this market. At this point, more money is coming into. In any given period, some. 4.3 definition, measurement, and functions of. the loanable funds market with two alternative shifts in the supply of loanable funds. This causes an increase in private savings, which increases national savings. S 1 indicates an increase. S 2 indicates a decrease (shift to the left) of the supply curve. the loanable funds market is an economic model used to analyze the market equilibrium for interest rates. 12 the market for loanable funds. The loanable funds theory was formulated in the 1930s by british economist dennis robertson and swedish economist bertil ohlin. Lumen learning, macroeconomics, introduction to financial markets. the result will be an outward shift of the supply curve.

From www.slideserve.com

PPT THE MARKET FOR LOANABLE FUNDS PowerPoint Presentation, free Shifters Of The Loanable Funds Market S 2 indicates a decrease (shift to the left) of the supply curve. 12 the market for loanable funds. the loanable funds market with two alternative shifts in the supply of loanable funds. 4.3 definition, measurement, and functions of. The loanable funds theory was formulated in the 1930s by british economist dennis robertson and swedish economist bertil ohlin.. Shifters Of The Loanable Funds Market.

From www.slideserve.com

PPT The Money Market and the Loanable Funds Market PowerPoint Shifters Of The Loanable Funds Market At this point, more money is coming into. the result will be an outward shift of the supply curve. S 2 indicates a decrease (shift to the left) of the supply curve. This causes an increase in private savings, which increases national savings. The vertical axis measures the real rate of. the loanable funds theory is a fundamental. Shifters Of The Loanable Funds Market.

From kidshelmetbike.blogspot.com

Loanable Funds Market Graph gaversichtva shifts in demand curve Shifters Of The Loanable Funds Market the loanable funds market with two alternative shifts in the supply of loanable funds. the result will be an outward shift of the supply curve. the loanable funds market is an economic model used to analyze the market equilibrium for interest rates. The loanable funds theory was formulated in the 1930s by british economist dennis robertson and. Shifters Of The Loanable Funds Market.

From www.chegg.com

Solved List the shifters of the demand and supply of bonds. Shifters Of The Loanable Funds Market the loanable funds market with two alternative shifts in the supply of loanable funds. the result will be an outward shift of the supply curve. The loanable funds theory was formulated in the 1930s by british economist dennis robertson and swedish economist bertil ohlin. At this point, more money is coming into. Lumen learning, macroeconomics, introduction to financial. Shifters Of The Loanable Funds Market.

From slideplayer.com

The Loanable Funds Market ppt download Shifters Of The Loanable Funds Market the loanable funds theory is a fundamental concept in economics that explains how the supply and demand for loanable funds affect interest rates in an economy. 12 the market for loanable funds. 4.3 definition, measurement, and functions of. the loanable funds market with two alternative shifts in the supply of loanable funds. At this point, more money. Shifters Of The Loanable Funds Market.

From slideplayer.com

Market for Loanable Funds ppt download Shifters Of The Loanable Funds Market 12 the market for loanable funds. the loanable funds market is an economic model used to analyze the market equilibrium for interest rates. the result will be an outward shift of the supply curve. 4.3 definition, measurement, and functions of. the loanable funds market with two alternative shifts in the supply of loanable funds. The vertical. Shifters Of The Loanable Funds Market.

From www.slideserve.com

PPT The Loanable Funds Market PowerPoint Presentation, free download Shifters Of The Loanable Funds Market In any given period, some. S 2 indicates a decrease (shift to the left) of the supply curve. the loanable funds market is an economic model used to analyze the market equilibrium for interest rates. the horizontal axis of the financial market shows the quantity of money that is loaned or borrowed in this market. 4.3 definition, measurement,. Shifters Of The Loanable Funds Market.

From www.youtube.com

Loanable Funds Market AP Macro Lecture YouTube Shifters Of The Loanable Funds Market The loanable funds theory was formulated in the 1930s by british economist dennis robertson and swedish economist bertil ohlin. the result will be an outward shift of the supply curve. S 1 indicates an increase. the horizontal axis of the financial market shows the quantity of money that is loaned or borrowed in this market. the loanable. Shifters Of The Loanable Funds Market.

From www.chegg.com

Solved The following graph shows the loanable funds market Shifters Of The Loanable Funds Market The vertical axis measures the real rate of. This causes an increase in private savings, which increases national savings. the horizontal axis of the financial market shows the quantity of money that is loaned or borrowed in this market. 4.3 definition, measurement, and functions of. the loanable funds theory is a fundamental concept in economics that explains how. Shifters Of The Loanable Funds Market.

From www.slideserve.com

PPT Macroeconomics Graphs PowerPoint Presentation, free download ID Shifters Of The Loanable Funds Market 4.3 definition, measurement, and functions of. the result will be an outward shift of the supply curve. In any given period, some. The loanable funds theory was formulated in the 1930s by british economist dennis robertson and swedish economist bertil ohlin. S 2 indicates a decrease (shift to the left) of the supply curve. At this point, more money. Shifters Of The Loanable Funds Market.

From www.youtube.com

Loanable Funds Video 3— Shifters of the Loanable Funds Market YouTube Shifters Of The Loanable Funds Market Lumen learning, macroeconomics, introduction to financial markets. The loanable funds theory was formulated in the 1930s by british economist dennis robertson and swedish economist bertil ohlin. 4.3 definition, measurement, and functions of. the loanable funds theory is a fundamental concept in economics that explains how the supply and demand for loanable funds affect interest rates in an economy. . Shifters Of The Loanable Funds Market.

From www.slideserve.com

PPT The Loanable Funds Market PowerPoint Presentation, free download Shifters Of The Loanable Funds Market the loanable funds market with two alternative shifts in the supply of loanable funds. S 1 indicates an increase. Lumen learning, macroeconomics, introduction to financial markets. In any given period, some. 4.3 definition, measurement, and functions of. the loanable funds market is an economic model used to analyze the market equilibrium for interest rates. This causes an increase. Shifters Of The Loanable Funds Market.

From courses.lumenlearning.com

Reading Loanable Funds Microeconomics Shifters Of The Loanable Funds Market the horizontal axis of the financial market shows the quantity of money that is loaned or borrowed in this market. At this point, more money is coming into. the loanable funds market with two alternative shifts in the supply of loanable funds. S 1 indicates an increase. the result will be an outward shift of the supply. Shifters Of The Loanable Funds Market.

From www.slideserve.com

PPT THE MARKET FOR LOANABLE FUNDS PowerPoint Presentation, free Shifters Of The Loanable Funds Market the horizontal axis of the financial market shows the quantity of money that is loaned or borrowed in this market. S 2 indicates a decrease (shift to the left) of the supply curve. This causes an increase in private savings, which increases national savings. the loanable funds market is an economic model used to analyze the market equilibrium. Shifters Of The Loanable Funds Market.

From www.youtube.com

Shifts in Demand for Loanable Funds YouTube Shifters Of The Loanable Funds Market the loanable funds theory is a fundamental concept in economics that explains how the supply and demand for loanable funds affect interest rates in an economy. S 1 indicates an increase. This causes an increase in private savings, which increases national savings. 4.3 definition, measurement, and functions of. the loanable funds market with two alternative shifts in the. Shifters Of The Loanable Funds Market.

From slideplayer.com

The Loanable Funds Market ppt download Shifters Of The Loanable Funds Market S 2 indicates a decrease (shift to the left) of the supply curve. S 1 indicates an increase. At this point, more money is coming into. the loanable funds market is an economic model used to analyze the market equilibrium for interest rates. the loanable funds theory is a fundamental concept in economics that explains how the supply. Shifters Of The Loanable Funds Market.

From slideplayer.com

The Loanable Funds Market ppt download Shifters Of The Loanable Funds Market S 2 indicates a decrease (shift to the left) of the supply curve. the loanable funds market is an economic model used to analyze the market equilibrium for interest rates. The loanable funds theory was formulated in the 1930s by british economist dennis robertson and swedish economist bertil ohlin. In any given period, some. the result will be. Shifters Of The Loanable Funds Market.

From www.economicsonline.co.uk

Loanable Funds Theory with Graphs Shifters Of The Loanable Funds Market In any given period, some. the loanable funds market with two alternative shifts in the supply of loanable funds. 12 the market for loanable funds. This causes an increase in private savings, which increases national savings. the loanable funds theory is a fundamental concept in economics that explains how the supply and demand for loanable funds affect. Shifters Of The Loanable Funds Market.